As of 2024, USDT, aka Tether, remains one of the most popular stablecoins in the cryptocurrency universe. Its market capitalization has solidified its position among the top cryptocurrencies – currently third-largest on CoinMarketCap. Stablecoins, as the name suggests, are a subset of cryptocurrency innovations driven by a desire to tackle the problems caused by the wild volatility swings in the valuation of bitcoin (BTC). While Bitcoin’s volatility has decreased somewhat by 2024, stablecoins like USDT continue to play a crucial role in providing stability in the crypto ecosystem.

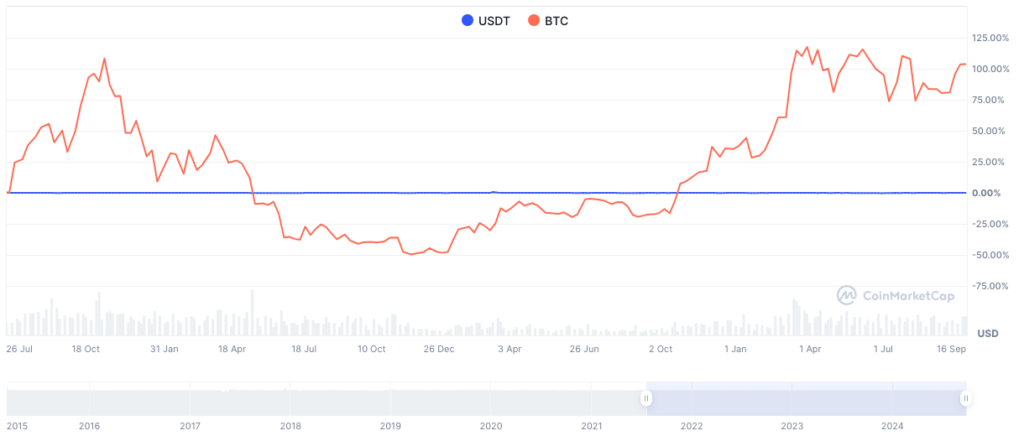

Volatility has long been a widely recognized problem (the precursor to Tether, then named Realcoin, was announced in July 2014), but the notion of stablecoins arguably really came into its own after the meteoric rise of bitcoin through 2017 was abruptly halted, and the rollercoaster ride of valuations through 2018 and 2019.

Contents

What is USDT?

USDT, more commonly known as Tether, is a cryptocurrency that belongs to a class called stablecoins. Unlike its more volatile cousins such as Bitcoin or Ethereum, USDT is designed to maintain a stable value – specifically, a 1:1 peg with the US Dollar.

Imagine USDT as a digital version of the US Dollar that can move freely within the cryptocurrency ecosystem. Each USDT token is intended to be worth exactly one US Dollar, providing a familiar point of reference in the often turbulent world of crypto.

Tether Limited, the company behind USDT, claims to maintain this peg by holding reserves equal to the number of USDT in circulation. These reserves, they state, include traditional currency and cash equivalents, and may sometimes include other assets and receivables from loans.

The concept is simple: for every USDT token issued, there should be one US Dollar (or equivalent) in Tether’s reserves. This promise of backing is what theoretically allows USDT to maintain its stable value, even as other cryptocurrencies experience wild price swings.

USDT operates on multiple blockchain platforms, including Ethereum, Tron, and others, making it a versatile tool in the crypto trader’s kit. Its stability and widespread acceptance have made it a popular choice for trading pairs on cryptocurrency exchanges, as well as a convenient way to hold value in the crypto world without exposure to high volatility.

However, it’s worth noting that USDT hasn’t been without controversy. Questions about the nature and extent of its backing have led to ongoing debates and regulatory scrutiny. Despite these challenges, USDT continues to play a crucial role in the cryptocurrency ecosystem, providing a bridge between the traditional financial world and the emerging digital asset landscape.

Why stability is important for wider adoption of USDT

For a store of value to be of any practical use in a transactive real-world sense, it cannot display drastically volatile characteristics that undermine its utility as a medium of exchange (as an intermediary between two parties), or as an acceptable unit of account (as a means for comparison or inventory).

Enter stablecoins.

A price comparison clearly shows the relative stability of USDT vs BTC (CoinMarketCap data).

The relative stability of stablecoins is achieved by pegging their value to some form of underlying collateral, be it a traditional fiat currency, which in Tether’s case (and many others) is USD, a basket of fiat currencies (such as Saga’s SGA), another cryptocurrency (like DAI to ETH), to a basket of crypto currencies, or to a commodity such as gold (PAX Gold).

The pegging of USDT to USD means that from a customer, business or investor perspective, payment can be made digitally – hence faster and cheaper than traditional methods – but essentially in a fiat currency.

In fact, once we begin to consider the collateralization of any token with an underlying asset that has value, the options are literally endless.

If the blockchain delivers its principle of universal decentralisation then any asset we choose could be digitizable – and some would argue that that is truly democratic and empowering. Individuals previously excluded by geography or deficient infrastructure from holding certain assets can now access an entire universe of assets through digital tokens. They are more empowered to express their investment philosophies, diversify their exposure and amplify their returns.

From monetary policy to regulating protocols

Fiat currencies are held stable (in the main) by the reserves that back them and the monetary authority (usually a central bank) that has tools to manage them. At the most basic supply-demand level, a central bank can utilise the sale of its foreign reserves for the purchase of its own currency (creating demand) to prop up its value, or sell its own currency and buy foreign currencies (creating supply) to weaken it.

Many stablecoins have some concept, or form of corrective mechanism, built into their blockchain or protocol to ensure that prices don’t stray too far from their chosen underlying asset – for those with underlying fiat currencies you can think of this as an algorithmic replacement of a central bank.

In Tether’s case, however, this has proven to be highly contentious because it uses its own so-called “Treasury” to mint new coins, in contrast to the decentralised nature of other coins mined along the blockchain. For the purist, here we hit an inherent contradiction in viewing stablecoins as cryptocurrencies. Central to Satoshi’s philosophy was the removal of “the inherent weakness of the trust-based model” that relies on third parties. This underpins the decentralised nature of bitcoin mining, whereas many stablecoins, Tether included, still require a centralised function with the (trust-based) promise that their coins are fully collateralised.

As of 2024, Tether has made significant strides in addressing past controversies. The company now provides regular attestations of its reserves, though debates about full audits continue. Regulatory clarity has improved in many jurisdictions, affecting how Tether operates.

With a current market cap (as of 2024, using CoinMarketCap data) over $118,000,000,000 USD, Tether has seen tremendous growth since its inception. This substantial increase in market cap reflects USDT’s continued importance and widespread adoption in the crypto ecosystem.

The growth of Tether’s market cap from 8.8 billion in 2020 to over 118 billion in 2024 represents a more than 13-fold increase in just four years. This dramatic expansion underscores USDT’s critical role in providing liquidity and stability to cryptocurrency markets, as well as its increasing use in various financial applications beyond simple trading pairs.

Tether as a gateway coin

In theory then, 1 USDT = 1 USD, which in a practical sense, can be clearly understood by anyone unfamiliar with the cryptocurrency space. Try explaining to someone why BTC or ETH are worth what they are at any given moment and you face an uphill struggle; even the semantics get in the way immediately.

While BTC may be valued at X, we could spend all day arguing whether or not it is actually worth X. But with USDT, the 1:1 ratio with USD is clear. So for anyone who may be looking to get into the cryptocurrency space, Tether removes that first tricky hurdle of understanding and provides an easy entry point.

For an individual wanting to make a simple digital payment, the idea that 1 Tether is merely a tokenised USD is very easy to understand. The simplicity of the concept has also led to Tether’s adoption by traders, who may find it easier to use than BTC in trading crypto pairs. Back in April 2019, Tether’s trading volume exceeded BTC’s for the first time and now outstrips that of all other cryptos by some margin. Tether means big business for crypto exchanges.

By 2024, Tether’s role as a ‘gateway coin’ has expanded beyond crypto trading. It now plays a significant role in decentralized finance (DeFi) applications and as a digital dollar equivalent in countries with limited access to US dollars.

Tether’s impressive market cap growth to $118 billion by 2024 has further cemented its position as a key ‘gateway coin’. Its increased liquidity and market presence have made it an even more important tool for entering and exiting cryptocurrency positions, as well as for transferring value across different blockchain networks.

Furthermore, due largely to know-your-client (KYC) and anti-money laundering (AML) requirements and policies at bricks-and-mortar banks on Wall St, many crypto exchanges do not have accounts with traditional financial institutions – making it very hard for them to actually hold USD.

The solution? Hold USDT instead.

Since 2020, the relationship between traditional banks and crypto exchanges has evolved significantly. By 2024, many major banks have established relationships with crypto companies, reflecting the growing mainstream acceptance of digital assets.

And really, it’s not hard to see the diffusion of innovation in play with cryptocurrencies as more and more people become open to the idea of adoption. The fact that BTC futures contracts even exist on the Chicago Mercantile Exchange (CME) is perfectly illustrative of this – and the point is only reinforced by the recent surge in open interest seen in them.

Yet with all this said, we have to remember that the crypto space is still a long way from being mainstream. As an asset class, cryptocurrencies are strictly speculative to anyone beyond – and still to many within – the space.

And why? Volatility. Not solely, but largely.

Cloudbet: Champions of innovation

We need to remember that this universe is still essentially in its infancy. Cutting-edge innovation and tech-driven solutions not only exist in an ever-changing world, but are often the drivers of those very changes. But like any nascent market, there will be growing pains and most likely a feisty, tumultuous adolescence before a mature market can bed itself down comfortably.

While bitcoin remains the granddaddy of all cryptocurrency, necessary innovations have led to the creation of a multitude of altcoins, and a booming concurrent marketplace. Bitcoin’s slow transaction settlement inspired the creation of Ethereum, with its faster and cheaper transaction execution, on a whole new blockchain, in turn spawning an explosion of decentralized apps – all of which, if they stand the test of time, could help raise digital adoption.

At the very least, this illustrates how a nascent cryptocurrency market is able to grow and develop so substantially in such a short period of time – thanks in no small measure to the fact that those operating in the space are also those sitting at the bleeding-edge of technological development.

It shows us that necessity drives not only invention, but innovation.

As of 2024, Cloudbet has further expanded its cryptocurrency options, now offering betting with 35+ cryptocurrencies, in addition to its established options like Bitcoin, Bitcoin Cash, Ethereum, and USDT.

Get betting with USDT at Cloudbet

Start betting in USDT right now.

At its inception in 2013, Cloudbet was one of the first sportsbooks and casinos to offer bitcoin betting. Since then, its pioneering spirit has focused on improving the user experience and broadening its markets. Cloudbet has now taken one more innovative step forward to offer USDT settlement.

- With USDT’s underlying fiat ratio, it’s easy to know how much you’re playing with

- The relative stability of Tether removes the risk of the wild swings in more traditional cryptocurrencies

- USDT provides the same benefits of privacy as other cryptocurrencies

- It’s easy to buy.

And what’s more, Cloudbet now offers an exciting Welcome Package for new customers. Enjoy up to $2,500 in cash rewards, 10% rakeback on all bets, daily cash drops, and the exclusive Cash Vault reward—all with no rollover requirements.