Updated 28th October 2021

In this article we’ll breakdown a Satoshi into its component parts and answer these questions:

- What is a Satoshi and how much is one Satoshi worth?

- What is mBit or millibitcoin and how much is it worth?

- What is a uBit or microbitcoin and how much is it worth?

We’ll also try and unravel some of the differing (and confusing) naming conventions that exist from the mighty single Bitcoin right the way down to the humble single Satoshi.

Even if you are somewhat familiar with bitcoin, you’re sometimes confronted with amounts that are denominated in units other than good old BTC, and ask yourself the question ‘what is a Satoshi and how much is it worth?’ There are surprising amount of these denominations, some of them quite obscure (like the ones that derive from the highly-geekish tonal number system).

But if you are a just a normal internet user (if there is even such a thing), it’s not likely that you will encounter anything more exotic than the Satoshi, the millibitcoin (mBTC), the microbitcoin (uBTC) and the bit.

By far and large, the Satoshi is the most widespread of them all. And it makes sense, given as a Satoshi is the smallest denomination of a bitcoin – the smallest unit in which we can divide one coin.

So, what is a Satoshi, why Satoshi, and how much is a Satoshi worth? Well read on, grasshopper, and dive deep into the annals of cryp-story.

Contents

Why Satoshi?

Satoshi Nakamoto is the pseudonym used by the mysterious creator of bitcoin, so the homage is well-deserved. It’s a little like putting historical figures’ faces in banknotes. But since bitcoin has no banknotes – or coins, for that matter – we can only assume the name should be enough to remember her/him/them by.

How much is one Satoshi?

In a nutshell, one Satoshi is worth exactly 1/100,000,000 (one one-hundred-millionth) of a bitcoin. In reality, the bitcoin code itself refers to these very small units, and one bitcoin is just the name its creators gave to 100,000,000 such units.

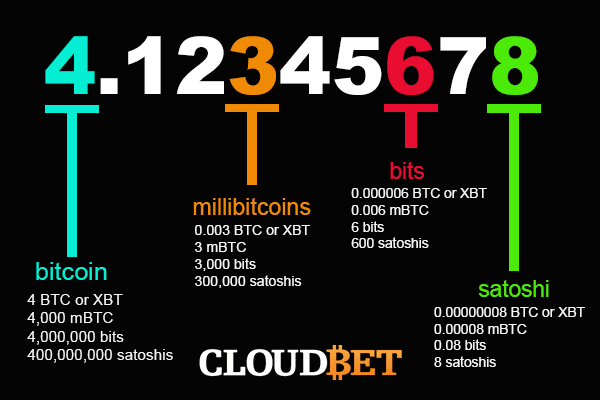

An image is worth a thousand Satoshi:

But to make it even more clear, let’s break one bitcoin down into its smallest pieces.

How many Satoshis in a bitcoin?

So, we can see from below the most popular denominations are pretty self-explanatory and follow the metric system – milli for one-thousandth, micro for one-millionth, and so forth.

- 1 Bitcoin = 100 000 000 Satoshis

- 0.1 Bitcoin = 10 000 000 Satoshis

- 0.01 Bitcoin = 1000 000 Satoshis

- 0.001 Bitcoin = 100 000 Satoshis

- 0.0001 Bitcoin = 10 000 Satoshis

- 0.00001 Bitcoin = 1 000 Satoshis

- 0.000001 Bitcoin = 100 Satoshis

- 0.0000001 Bitcoin = 10 Satoshis

- 0.00000001 Bitcoin = 1 Satoshi

How to calculate value in Satoshi, mBTC, and uBTC

To calculate the value when you are confronted with one of these units, you need to take two steps:

- Convert the amount to bitcoin

- Multiply it by the exchange rate on your currency

Let’s go through this with an example. Let’s say Alice would like to pay for her coffee at a crypto-friendly coffee shop and the menu shows that the price is 5 mBTC (five millibitcoin). Being a clever human, Alice knows exactly what to do.

First of all, she makes sure to note the “m” before the BTC, which denotes the price is in millibitcoin. From there, she converts it to bitcoin. It’s easy – just divide it by 1,000.

5 mBTC = 5 / 1,000 = 0.005 BTC

From there, it’s easy. Let’s say that one bitcoin is worth €4,500 at that moment. So Alice just needs to multiply the two values:

0.005 x 4,500 = €22.50

Which is quite an expensive coffee, and Alice regretted not doing this math before ordering it.

But wait, there is a twist. So it happened that she had misread the menu, as there was some dry coffee covering up the price.

As she cleared it, instead of mBTC, she noticed that the price actually stated 5 uBTC – microbitcoin. So she actually needs to divide it by one million. Ah, she thinks, now we’re talking. Redoing the math,

5 uBTC = 5 / 1,000,000 = 0.000005 BTC

And in Euro,

0.000005 x 4,500 = €0.0225

Alice takes a deep sip and savours the cheapest and tastiest crypto-coffee she has ever tried.

Why should alts trade be calculated in Satoshis and not USD?

This concept can be hard for new cryptocurrency traders to understand, but the easiest way to explain it is to remember that alts trade is a style of trading used to take advantage of the high volatility experienced with cryptocurrency trading in general.

If trading strictly with only a BTC / USD pair, a trader effectively limits their opportunities and the chance of trading when another coin begins spiking against bitcoin and the dollar. If they are trading altcoins against BTC, it allows a trader to purchase more BTC with their original investment at the right time, which means they are making a profit.

Usually, traders who follow this style will be banking on bitcoin to rise again and beat the previous high, which is when they will cash out to USD and then often start the cycle over again. The bears will also use this method in reverse, waiting for an altcoin to drop against BTC and make a trade, gaining higher amounts of the altcoin with bitcoin than they previously would have. When the altcoin takes off again and rises either against bitcoin or the dollar, the trader can cash out and will be in profit.

What is the future of Satoshi & BTC?

Months and months of bitcoin price stagnation were followed by a promising start to April, and things have been looking up ever since. A 20% rise at the beginning of the month preceded a new high for 2019 as the price of 1 BTC pushed past the €5,000 mark, reaching €5,030 on April 24th. And if that weren’t encouraging enough, the cryptocurrency has also hit the ‘golden cross’ for the first time in 3.5 years, with the 50 day moving average surpassing the 200 day moving average – just as it did in October 2015 before the exponential price rise to just over €17,000.

Whilst the circumstances do seem favourable, and bitcoin does seem to be doing alright, it’s vital to remember that predictions based on historical data and future hypotheses simply are not fact. It’s important to be prepared for all outcomes in the crypto market – just as you are with your umbrella when it starts to rain, even though the TV weather-man anticipated clear skies and a shining sun.

What should be noted, however, aside from price, is that Bitcoin is a flourishing network that has, and continues to, revolutionise technology. With more and more individuals, businesses and countries investing into its protocol and adopting the cryptocurrency, the future certainly looks bright. Perhaps the umbrella won’t be needed after all.

How to exchange Satoshi to bitcoin?

If you’ve paid close attention all the way through this article, you’ll be looking at the question above with a smile on your face – because, as we now know, a Satoshi to a bitcoin is what a cent is to a Euro: the same currency, just different units, meaning exchanging one to the other simply isn’t possible.

What is possible, however, is using your Satoshi at Cloudbet to win even more of it, by taking advantage of our lowest minimum stakes and betting with only 10 Satoshi today.

Let’s do the math:

10 Sat = 10 / 100,000,000 = 0.00000010 BTC

With bitcoin at around 4,500 Euro,

0.0000001 * 4,500 = €0.00045

This means you could place around 21 bets for one euro cent. What are you waiting for? With 21 chances to win, and the price of BTC following an upward trend, you’ve got a great chance to significantly multiply your stake by betting at Cloudbet today.

PS: a bit of trivia. 10 Satoshi equals one Finney – an unusual denomination and posthumous homage to Hal Finney, Satoshi’s closest collaborator and the second person to ever run a BTC node, who unfortunately died in 2011. So we guess it takes one Finney to gamble.