Since its launch in 2013, a pioneering spirit has been, and remains, central to Cloudbet’s ethos and its approach to delivering next-level experiences.

In its constant bid to advance through innovation, Cloudbet is proud to now add Paxos Gold, also sometimes referred to as Pax Gold (PAXG), to the list of cryptocurrencies that players can use in its bitcoin sportsbook or Cloudbet’s bitcoin casino.

Cloudbet users can choose between playing with bitcoin (BTC), ethereum (ETH), bitcoin cash (BCH), USDT (Tether), USD Coin (USDC) – and now Paxos Gold (PAXG).

This amplifies Cloudbet’s position not only as the leading bitcoin casino and sports betting operator, but also the leading crypto casino and sports betting operator.

Contents

What is PAXG?

Paxos Gold is a stablecoin linked to the price of one ounce of gold. Its ticker is PAXG.

In September 2019, the Paxos Trust Company launched Paxos Gold, building on its creation a year earlier of the Paxos (or PAX) Standard – another stablecoin pegged to the USD (ticker PAX).

Both exist and transact on the Ethereum blockchain and therefore utilise ERC-20 protocol smart contracts.

Each PAXG token is collateralised by one ounce of a 400oz London Good Delivery gold bar, stored in the vaults of Brinks of London – as such, the price of PAXG (in theory) moves in tandem with the spot price of gold.

Importantly, any entity or individual who owns PAX Gold owns the underlying physical gold held in custody by Paxos Trust Company.

PAXG is not a widely circulated gold coin, with less than 35,000 coins in circulation. According to latest CoinMarketCap data, it ranks 126 in terms of market capitalisation, which stands at a little more than $65.5 million. There are only about 3,600 PAXG addresses that contain any balance, according to IntoTheBlock – and 52 of those collectively own close to 90% of PAXG’s market cap.

How PAXG works

Stablecoins

As we’ve said, PAXG is a stablecoin. The Cloudbet Blog has written extensively about stablecoins before, and the function they provide in removing the volatility (primarily) of the bitcoin price. This has a number of positive consequences, not least of all making them viable transactional currencies rather than a store of value – which bitcoin remains.

Stablecoins can also serve as a safe haven to protect any increase in value that an investor may have built in cryptocurrencies – or in the case of the ever-increasing number of investors, park earnings temporarily (thus removing the threat of wild swings in price) before deciding when to buy back in to the market, or indeed cash out.

This is illustrated by the immense amount of daily volume seen in USDT, the go-to USD-pegged stablecoin of the trading world.

Of course, this only holds true if the underlying asset used as collateral holds its value over time. In the case of gold, this offers some unique advantages compared to other stablecoins that are more commonly pegged to a fiat currency like the US dollar.

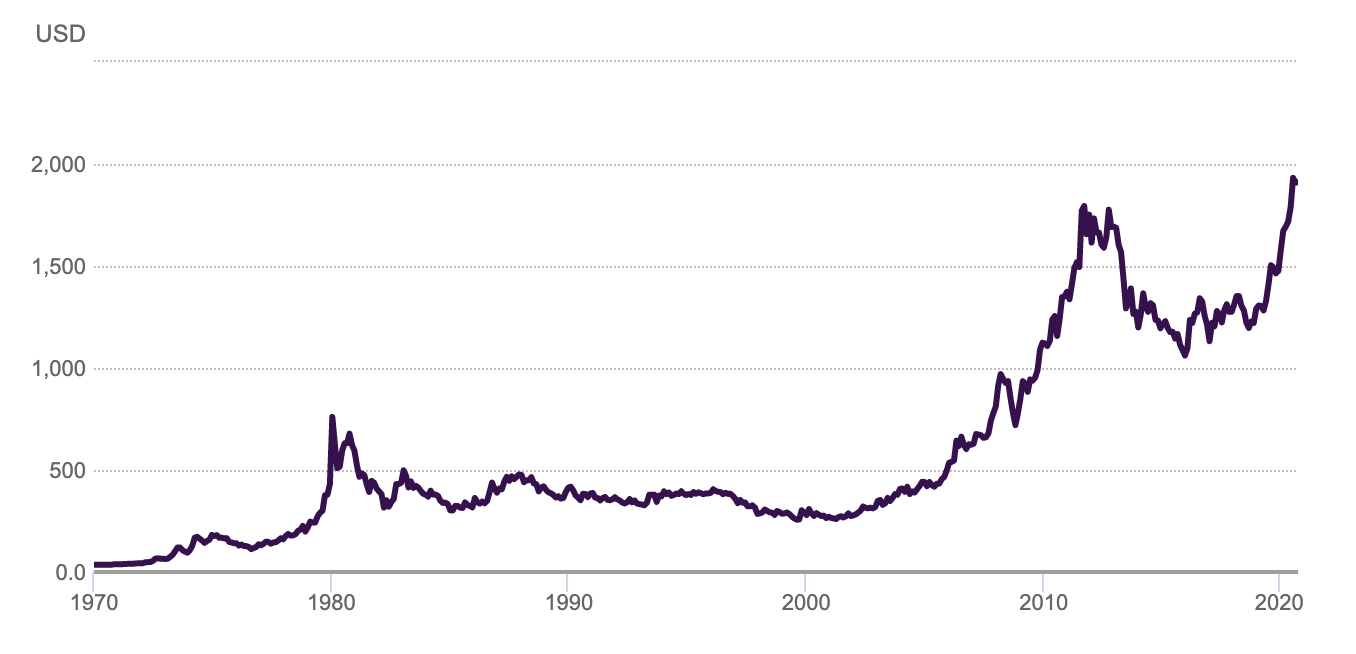

A brief word on gold’s value

Now, it is not the purpose of this post to delve into the many arguments around whether or not gold serves as an effective store of value, or whether it’s inflation-fighting qualities will hold up at a time when the Fed and many central banks around the world are printing fiat currencies at a mind-boggling rate to keep their economies afloat. We shall keep this for another day, perhaps.

What we will note here is the fact that gold holds value for the simple reason that we, as human beings over the centuries, have decided to value it.

Through the ages gold has held a place of actual and symbolic importance – i.e., value – to us. Its prestige remains today, central to many cultures, especially in Asia, that value it as a store of wealth to be passed from one generation to the next. For proof of this, one need only attend an Indian or Chinese wedding ceremony.

From an investment perspective, gold has also long been considered a safe haven in times of uncertainty or volatility – indeed, look at the run its price has had recently. The price of gold has recently fluctuated in a range around $1,890-$1,980/oz.

Lastly, gold’s scarcity also adds value. The World Gold Council estimates that fewer than than 200,000 tonnes have been mined throughout all of history – and of that, around two-thirds since 1950. Annually, mining adds only 2,500-3,000 tonnes to the above-ground stock.

Freeing value – The power of tokenisation

Deciding to buy or invest in gold is all well and good, but traditionally it has been a buy-and-hold asset. But while buying – and sitting on – gold may help you hold on to your wealth (enter the inflation hedge argument), it doesn’t make for a particularly easy, liquid, transactional solution.

It is in the tokenisation of the precious metal that gold coins like PAXG represent that makes for one of the most important innovations in this brave new world of digital currencies – because it offers a solution to a very practical problem.

The tokenisation of the underlying gold suddenly makes the value of that gold accessible and liquid for use to the same extent that, in the case of PAXG, any other cryptocurrency or token on the Ethereum blockchain can be used transactionally.

Tokenisation means that suddenly the value in your gold bar is freed.

As a digital asset, one PAXG is immediately divisible, making it easy to slice up your gold to exchange. Suddenly you have real gold that is eminently tradable.

Consider this concept through the words of Paxos CEO Charles Cascarilla: “Either you can make gold very tradable or you can own real gold… And very tradable gold is not real gold.”

If that’s a little baffling, let us explain. In referring to “very tradable gold”, Cascarilla means the financial instruments that traditional financial institutions sell to allow people to “trade gold” – such as derivative contracts and ETFs. All these really are, are paper contracts that investors can buy and sell, but they really only trade the gold price, not the underlying commodity itself. Investors can “buy and sell” gold, and make money along the way, but no real gold ever changes hands.

Because ownership of PAXG gives the holder the right to take delivery of the underlying asset, when PAXG is bought and sold, so too is the underlying metal.

Which means for anyone who wants to own gold, they 1) now have easy access to it; and 2) they can now utilise the asset of their choice like never before. The tokenisation process means PAXG has a utility that gold does not.

And that is worth dwelling on.

Sorry to get all meta for a minute, but if you take that thought and run with it, the act of tokenisation essentially opens up the scope of opportunity to tokenise almost anything – provided the collateralised asset is sound and the issuer of the token is trusted (we’re not going to get into the centralisation controversy posed by stablecoins in this article, but we do deal with PAXG’s provenance below).

Any illiquid asset that is deemed to have inherent value, suddenly becomes a usable form of transactional currency. A billion-dollar art collection?

Would you, if you could, sell the Mona Lisa’s smile? Though if you would, we hope it would be for something more than a Lambo…

Would you, if you could, sell the Mona Lisa’s smile?

And it’s happening. Securtised Token Offerings (STOs) are the new ICOs, though they don’t always go to plan – just ask NBA basketball player Spencer Dinwiddie. That said, Cloudbet is compelled to say, kudos for trying, man… kudos for trying.

Benefits of using crypto

Of course, PAXG shares the benefits offered by blockchain technology. Using the Ethereum blockchain, transfers can be made to anyone, anywhere in the world, with an Ethereum wallet. Transactions are cheap compared to what it would cost if trying to execute the same transaction over traditional financial infrastructure, and are executed almost immediately – a huge benefit over the days, or possibly longer depending on the complexity of the transaction, it would generally require using traditional fiat methods.

As mentioned, stablecoins also offer a certain level of security in that their relative lack of volatility means investors can protect the value created by way of their exposure to other cryptocurrencies – locking that into PAXG and reducing volatility to that of the gold price.

How safe is PAXG? – The trust factor

For anyone unfamiliar with the world of cryptocurrencies – and arguably, even more so for those who are – it is important to remember that the entire sector is really still in its infancy, despite the great strides being made.

With that comes space to ask legitimate questions before diving in.

First and foremost, the Paxos Trust Company is regulated by the New York State Department of Financial Services, and regularly audited. The company says its accounts are audited monthly, and all its PAX tokens are fully collateralised.

The NY DFS also regulates PAXG, and as far as collateralization of PAXG tokens is concerned, remember that the underlying gold is held in vaults in London.

Another important fact to bear in mind is that Paxos, as a trust company, is also licensed and qualified to act as a cryptocurrency custodian, adding further gravitas to its legitimacy.

Cloudbet – Raising the game

In the quest to constantly enhance the next-level experience for our players, Cloudbet strives to advance through innovation. One way this manifests itself is in the expansion of the number of cryptocurrencies available to play with at Cloudbet.

The addition of Paxos Gold is the latest step in a continuous journey, building out a currency stable that already includes BTC, ETH, BCH, USDT and USDC.

Opening an account at Cloudbet takes just minutes, and new players can take advantage of the exciting Welcome Package! Enjoy up to $2,500 in cash rewards, 10% rakeback on all bets, daily cash drops, and the exclusive Cash Vault reward—all with no rollover requirements. Play with BTC, ETH, BCH, PAXG, USDT, USDC, and more—Cloudbet is here to raise the game for you.